Following their May 2025 merger, Capital One and Discover face scrutiny as customers report mixed service quality across user segments.

· Capital One and Discover completed their merger on May 18, 2025.

· Customers are now asking: “Will my experience get better or worse?” · Initial trends in customer service post-merger, based on BankQuality proprietary insights.

Big news just dropped in the world of banking. US-based Capital One and Discover, two major credit and banking companies, officially merged on May 18, 2025. The deal is affecting how millions of people manage their money, but the big question is: Will customer service improve?

Some customers hope for smoother services and better rewards, but others are concerned about long waiting times and confusion about new policies.

What are regular customers expecting?

For everyday users, banking should be really simple. Customers want easy-to-use apps and websites, responsive customer support, clear communication, and hassle-free account changes. They expect improvements like a unified app, single login credentials and broader access to ATMs via shared networks. However, early concerns have emerged, including app glitches, login issues, and long customer service wait times.

Small business owners: Help or hassle?

Small businesses rely havily on banking services. Owners need fast support for payment problems and easy access to credit. Post-merger, business owners could benefit from improved digital tools, lower fees and easier access to loans through a larger institution. However, current feedback indicates pain points: delays in settlments, inconsistent support and staff unfamiliar with new policies. Longer processing times are being reported, particularly by SMEs adjusting to the new system.Tech savvy users and digital experience

In today's digital-first environment, mobile banking is the norm. Tech-savvy users expect seamless mobile experiences, secure login and intelligent support. The merger’s benefits include one strongly well-designed app and 24/7 chatbot or live chat functionality. However, some digital setbacks have also been reported, including login issues with the new app and slower app response.

Low-income customers and credit builders

Low-income users and those rebuilding credit often face the biggest hurdles when banks merge. These customers depend on low fees and clear terms and fair dispute resolution. The merger offers potential improvements — expanded access to secure credit cards and simplified credit building options. However, problems could emerge, like changes to fee structures and reduced availability of secured products.

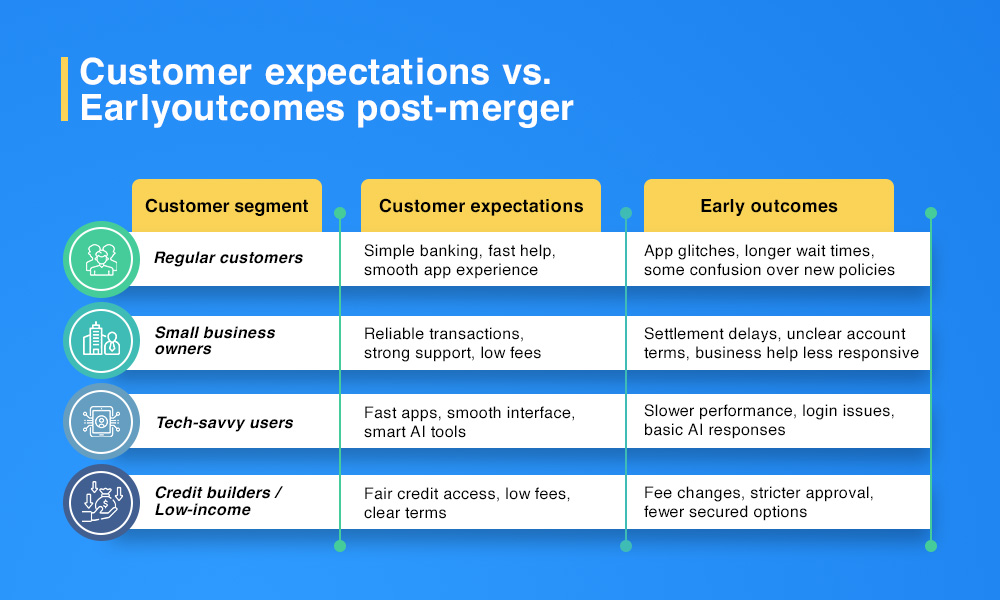

Customer expectations vs. earlyoutcomes post-merger

Customer segment Customer expectations Early outcomes

Regular

customers Simple banking, fast help, smooth app experience App glitches, longer wait times, some confusion over new policies

Small

business

owners Reliable transactions, strong support, low fees Settlement delays, unclear account terms, business help less responsive

Tech-savvy

users Fast apps, smooth interface, smart AI tools Slower performance, login issues, basic AI responses

Credit

builders /

Low-income Fair credit access, low fees, clear terms Fee changes, stricter approval, fewer secured options

In-person

service, phone

support, no tech

headaches Longer phone waits, push toward app usage

Young

adults /

Students Good rewards, quick credit, easy digital tools Mixed credit access, digital tools improving but not fully stable

The Capital One-Discover merger is still in its early days, and some operational bumps are expected. However, customer service appears to face growing pains, especially among business users, digital-first customers, and credit-sensitive groups. As the integration continues, users may adapt and stabilise. Stay tuned to BankQuality for more merger updates!